F.A.Q.

Why form a company in Spain?

After the European borders were opened in 1993, all European nationals were able to form a company in a Member State of their choice without the obligation to live there and this is within respect for national company law, pursuant to the 11th Council of Europe Directive (89/666/CE).

To ensure compliance with the Decree of 30th May 1984 (on registration in France of trading companies with their registered office abroad) of the European Union Directives, the 11th Directive was transposed to French law by decree number 92,521 of 16th June 1992, published in the official gazette on 17th June 1992. Likewise, the other European countries have transposed that directive to their national law.

How long does it take to complete the purchase of a Spanish SL?

As of the moment when we have all your information and documents, the incorporation time depends more on your availability to attend an appointment with us to sign the papers required to form the company. In general, you may obtain an appointment within 48 hours, even less in certain cases.

Do I have to travel to form my company?

The presence of the administrator is essential, although if you have shareholders, the share transfer may be performed remotely.

When will the company be operational?

The company is ready to bill from the day of signing before the Notary Public.

What are your payment conditions?

To reserve your company, we ask you to first pay a transfer deposit of € 500. You will pay the balance on the day of attending to sign, either in cash or by bank card.

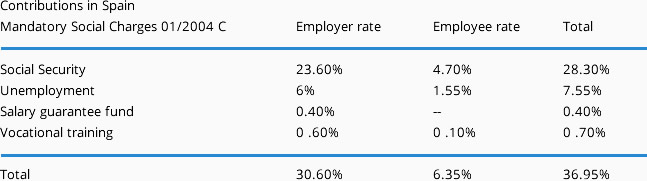

What are the charges for an S.L.?

Which banking regulations?

A European directive regulates transfers from one country to another. For transfers with a value under € 50,000, the delay in making the funds available is a maximum of 6 days. Double withdrawals are forbidden and payments not achieved are reimbursed with interest. Moreover, the clients must be informed of the delays, of the exact charges and the possible pleas. Specific regulations also apply to cross-border transactions to make them similar to transactions performed within the same country (withdrawals from distributors, transfers, operations with bank cards).

Money transfers to a European personal account are free below € 7,600 per transaction. Above that sum, whether of money, titles or securities, a declaration to the customs authorities is mandatory (anti-money laundering laws).

May I form a company while prohibited to manage or perform banking operations in France?

There is no prohibition on a company being formed by persons prohibited to manage or subject to banking prohibitions.

Do not hesitate to contact us: we will do our utmost to provide you the best advice according to your needs and to prepare a customized estimate for you.

Creation of your Web Site

Multiple language showcase: French, Spanish and Catalan.

WEB START PACK: for presentation internet site.

Specific, effective design to suit your image, careful ergonomics, referencing optimisation … The Web START PACK is the solution par excellence to get your activity ahead on the Internet.

- Up to 5 web pages (home and presentation, your services or products, contact page and site map)

- Design, logo, presentation photos and videos

- Hosting for 1 year

- Choice of domain name

- E-mail address

- Placement on the main search engines (Google …)

- Traffic statistics

- Maintenance

- Total discounted price for our clients : € 690